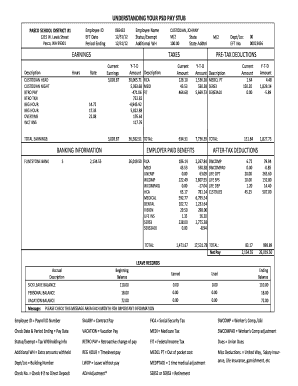

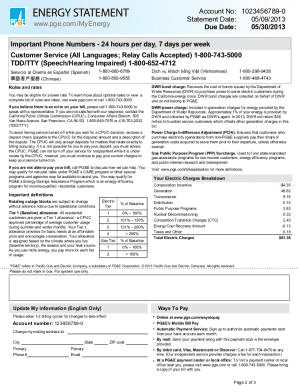

Get the free pay stub template with calculator

Show details

HOW TO PRINT/VIEW PAY STUB ON EMPLOYEE ONLINE 1. 2. 3. 4. Go to the main FUND web page: www.fusd1.org Click on Resources for Faculty & Staff Click on Employee Online Type in your IFAS User#. (This

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign paystub generator no watermark form

Edit your paystub template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pay stub template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pay stub template with calculator no watermark online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit check stub template form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out paycheck stub template form

How to fill out pay stub template:

01

Gather all necessary information: Make sure you have all the required information such as employee's name, address, social security number, and pay period dates.

02

Fill in the employee's information: Start by entering the employee's name, address, and social security number in the designated sections of the pay stub template.

03

Enter the pay period: Indicate the start and end dates of the pay period. This is important for accurate record-keeping.

04

Provide details of earnings: Fill in the employee's gross earnings, which include regular wages, overtime pay, bonuses, commissions, or any other forms of income. Make sure to accurately calculate these amounts.

05

Deduct applicable taxes: Subtract any federal, state, or local taxes from the employee's gross earnings. This may include income taxes, Social Security taxes, Medicare taxes, and other withholdings.

06

Subtract additional deductions: If the employee has any other deductions, such as health insurance premiums, retirement contributions, or union dues, subtract them from the employee's earnings.

07

Calculate net pay: Subtract the total deductions from the gross earnings to calculate the net pay, which is the amount the employee will receive.

Who needs pay stub template:

01

Small business owners: Pay stub templates are essential for small business owners who need to provide their employees with accurate records of their earnings and deductions.

02

Employees: Having a pay stub template helps employees keep track of their earnings, taxes, and other deductions. It serves as proof of income for various purposes such as applying for loans or leases.

03

Accountants and payroll professionals: Accountants and payroll professionals utilize pay stub templates to accurately calculate and document employee earnings and deductions for tax and auditing purposes.

In conclusion, anyone involved in payroll management or requiring proof of income can benefit from using a pay stub template. It ensures accuracy, organization, and transparency in the payroll process.

Fill

fillable pay stub pdf

: Try Risk Free

People Also Ask about pay stub template with calculator word

How do I make a paycheck stub in Word?

How it works Open the check stub template and follow the instructions. Easily sign the pay stub template word with your finger. Send filled & signed make a paystub or save.

What happens if you use pay stubs?

You could also be setting yourself up for a serious legal issue. There are fines that could total more than $1 million and you could even face jail time. It's probably not worth it to create a pay stub, especially to defraud a financial institution.

Does Microsoft have a pay stub template?

Templates for payroll stub can be used to give your employees their pay stubs in both manual and electronic formats. Free Microsoft Excel payroll templates and timesheet templates are the most cost-effective means for meeting your back office needs.

Can you pay stubs?

Paystubs are easy to generate These pay stubs look legitimate and are nearly indistinguishable from a real pay stub. Scammers can enter any information they want to fraudulently qualify for a rental, opening up the property to risk – financially and reputationally.

Do pay stubs have watermarks?

Most legitimate paystubs will have a watermark. If the document you are looking at does not have a watermark, then it is likely that it is .

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my paystub generator with calculator in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your check stub maker with calculator and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete pay stub template with calculator pdf online?

pdfFiller has made it easy to fill out and sign check stubs template. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an eSignature for the printable check stubs in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your pdf filler pay stub and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is pay stub template with?

A pay stub template is a standardized form used by employers to outline employee earnings, deductions, and net pay for a specific pay period.

Who is required to file pay stub template with?

Employers are required to provide pay stubs to their employees as part of payroll documentation, although specific filing requirements may vary by jurisdiction.

How to fill out pay stub template with?

To fill out a pay stub template, input employee information (name, address), earnings (hourly wage/salary), hours worked, any deductions (taxes, benefits), and the total net pay.

What is the purpose of pay stub template with?

The purpose of a pay stub template is to provide employees with a clear record of their wages and deductions, ensuring transparency and accountability in payroll processing.

What information must be reported on pay stub template with?

A pay stub template must report employee details, pay period dates, gross pay, itemized deductions (taxes, insurance, retirement contributions), and net pay.

Fill out your pay stub template with online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pay Stub Generator With Calculator is not the form you're looking for?Search for another form here.

Keywords relevant to check stub template with calculator

Related to check stub maker

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.