Get the free pay stub template word download

Get, Create, Make and Sign pay stub template with calculator word form

Editing word paystub template online

How to fill out check stub maker without watermark form

How to fill out pay stub template:

Who needs pay stub template:

Video instructions and help with filling out and completing pay stub template word download

Instructions and Help about pay stub template with calculator pdf

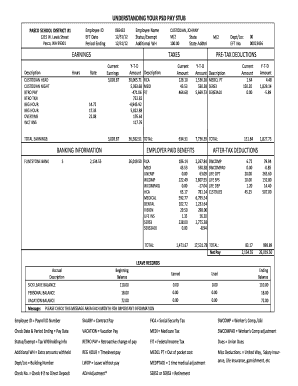

And welcome back to another podcast with Mr Haggis on this podcast I'm going to continue talking about the personal income tax formula, so we're going to continue building this formula that we've been working on through the videos on this playlist and to do, so I'm going to start you'll see that there's some new items here, but I'm going to ignore them for a moment I'm going to come down here to the bottom and I just want to clean this up a little down here, so the first thing is when I want to get this centered here, so I'm just going to Center these, and then I'm going to change some colors here, so I just want to add a little of color so that we can highlight everything, so it's nice and easy on the eye so for along the top I'm going to put this darker color right here it's kind of whatever that color is I'm going to put that there along the top and then for all of these I'm going to go with a slightly light lighter color just to highlight them, so we'll go with a slightly lighter color and then down here on the bottom for my final answer I'm going to right-click format cells again, and I'm going to go back to that a little darker color just to make some things stand out so, so now we've got this looking a little better down here and these tax brackets well right now of course these are just tax brackets I made up I just made numbers up and put them in we'll put some real numbers in here later on, and we'll play with this once we get this final thing this final calculator built we'll come in, and we'll play with these now the other thing I want to set up here is I want to set up a paycheck stub so the way we're going to set up a paycheck stub you can see that I've added things, and you'll want to just pause me for a second and add these yourself we're gonna start here on a 14 we're going to have the different categories listed on your paycheck stub and then along the top we're going to have your tax rates that you face for different things your income your spouse's income and your total income, and we're going to build what a paycheck stub might look like so let's start with let's start with the federal now federal we don't have to put anything because your federal tax they're being calculated by all this craziness down here that's gonna feed into all this craziness up here, so that's being handled we've already dealt with the federal taxes, so we're not going to deal with theirs right now Social Security Medicare state taxes local taxes unemployment taxes we're going to add those, so before we do that we want to format these cells so from Social Security down to unemployment we want to format these cells, and we want them to be here we go we're going to go in a number, and we want those to be percentages, so we're going to put percentages in here, and I'm going to go to two decimal places on them, so that's going to format these cells and then let's let's put our tax information in here, so Social Security is at least the time that I'm doing...

People Also Ask about pay stub template with calculator

How do I make a paycheck stub in Word?

What happens if you use pay stubs?

Does Microsoft have a pay stub template?

Can you pay stubs?

Do pay stubs have watermarks?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my paycheck template word in Gmail?

How do I complete paystub template for word online?

Can I create an eSignature for the pay stub template with calculator no watermark in Gmail?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.